- August 29, 2024

- by Jesse Feinberg

If you operate an energy-intensive industrial or manufacturing facility in Consumers Energy territory, onsite solar is likely to be an attractive investment. Our analysis shows that significant electricity users can expect a payback period of 6-7 years with a 9-10%+ IRR. Read on to understand more about which Consumers-specific variables are driving these economics.

Consumers Energy avoidable costs are particularly high for industrial users

Based on our analysis of customer bills as well as the Consumers Energy ratebook, the typical industrial or manufacturing facility in Consumers Energy territory pays 9.5-10.0¢ per incremental kilowatt-hour (kWh) consumed. We call this the “avoidable cost” of electricity because the cost can be avoided by consuming one fewer kilowatt-hour (i.e. for each incremental kilowatt-hour produced by an onsite solar system).

Consumers Energy’s avoidable cost is relatively high compared to peers. For example, DTE Energy’s avoidable cost is approximately 7.5¢ per kWh, 23% cheaper than Consumers Energy.

Net metering probably isn’t an option for large Consumers Energy customers

Net metering allows generators of electricity to capture the full retail value of any electricity they don’t consume onsite and instead export it to the grid. However, Consumers Energy limits net metering to systems under 0.55 MW – a system size which falls well short of the ROI-maximizing size for most large industrial or manufacturing facilities.

Also, Consumers Energy stopped accepting new net metering applications on November 19, 2020 for all system sizes. As a result of these limitations, we expect that an onsite system would receive effectively zero value for any electricity export. This has the effect of making oversized systems unattractive.

Large Consumers Energy customers are best served by non-export systems

The economics we described above (6-7 year payback; 9-10%+ IRR) assume instead the installation of a non-export system. We expect the optimal system size for large energy users in Consumers Energy territory to be at least 1.00 MW and likely larger, but not so large that the system exports any significant amount of electricity.

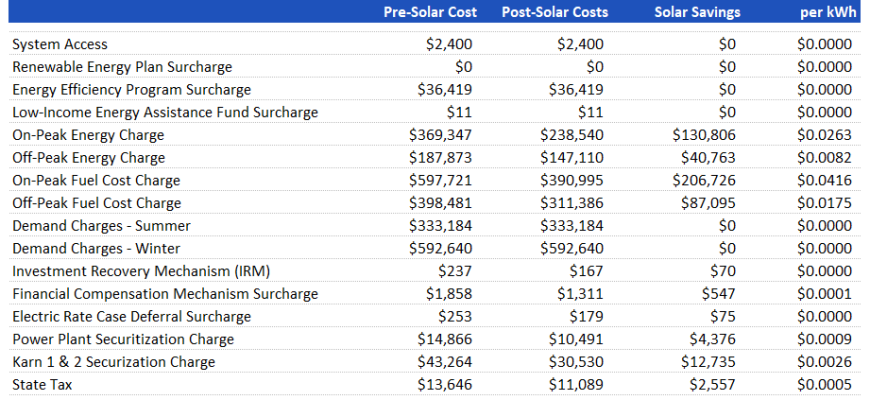

A non-export system has the best economics when the facility it serves has high, steady hourly usage during periods of solar production. Attractive economics are further enhanced when the facility’s usage curve aligns well with the solar production curve (i.e. more usage in summer months). This also makes sense from an avoidable cost perspective: the Consumers Energy on-peak energy charge rate (not to be confused with the overall avoidable cost, which includes the energy charge rate and other ‘per kWh’ charges) is higher in summer (e.g., 4.45¢/kWh) versus winter (e.g., 3.40¢/kWh). The same holds true for the off-peak energy charge rate (see image below).

Consumers Energy Ratebook

Widely available tax benefits can mitigate the cost of a system

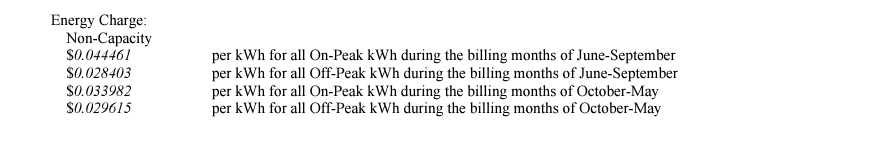

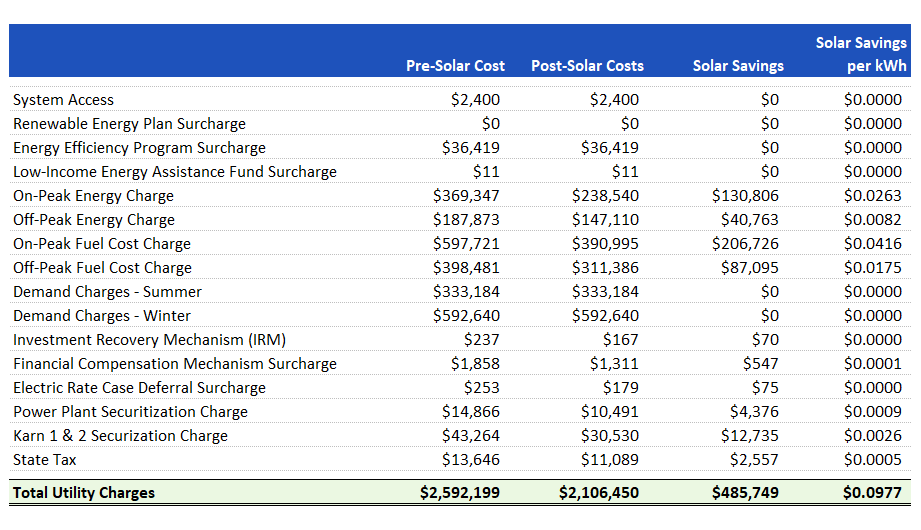

For the typical large industrial or manufacturing facility in Consumers Energy territory, we expect a solar system to generate savings of 9.5-10¢ per kilowatt-hour. Consider the economics (in the image below) for a 3.25 MW system we designed for a Consumers Energy customer using about 17,000,000 kWh annually. This system produces about 5,000,000 kWh annually, does not export to the grid, and will save this customer nearly $500,000 per year (9.77¢ / kWh).

Example Solar Savings Chart for a Consumers Energy Customer

We’ve looked at the benefit side of the equation, but what about the cost of a solar system? Costs vary depending on a wide range of factors including equipment and construction costs. Offsetting these costs to some extent are two major federal tax benefits. These are (1) the investment tax credit (ITC) and (2) accelerated depreciation, which combine to represent 45-50% of the cost of a solar system.

The investment tax credit is equal to 30% of the cost of the project and results in a dollar-for-dollar reduction in income taxes owed. For example, a $1,000,000 solar system would create a tax credit of $300,000, which would reduce income taxes owed by $300,000. The ITC is available for projects placed in service by 2033.

Accelerated depreciation creates losses which reduce taxable income. The math is more complicated than for a tax credit, but for the typical solar project, the resulting reduction in taxable income creates a tax benefit worth 15-20% of overall project cost. Combine that with the 30% benefit from the ITC and you end up with tax benefits covering 45-50% of the project cost.

It’s reasonable to expect a 6-7 year payback

Obviously we’re generalizing, but based on our experience developing solar projects, including in Michigan and Consumers Energy territory, we believe the typical large-scale project (typically for an industrial or manufacturing facility that uses a lot of electricity) can achieve a 6-7 year payback with a 9-10%+ IRR. This assumes a 9.5-10.0¢ / kWh avoidable cost, non-export to the grid, and the standard federal tax benefits.

Learn More

Does it seem like onsite solar might be a good solution to meet your economic and energy goals? Fill out the form below to get started.

Nokomis Energy is a clean energy developer focused on the Upper Midwest and Mountain West regions. Our mission is to identify opportunities to create clean, low-cost energy projects for our customers. We work directly with our customers and partners to implement and build clean energy solutions that work for your specific needs.