- July 12, 2024

- by Dan Rogers

If you’re in an industry other than energy generation, you may wonder whether investing in an energy-generating asset is the best use of your capital. You’ll get the highest return by investing in your area of competitive advantage, however if you use a lot of energy – if energy is a major cost in your value chain – it is probably worth considering including energy related assets on your balance sheet to reduce operating costs and hedge a volatile expenditure, given recent electricity demand forecasts and fuel volatility

Why you should consider owning energy generation

What makes solar worthy of consideration for placement on one’s balance sheet is that it not only reduces operating costs, but it also provides a hedge against rising electricity prices for some percentage of your overall electricity costs. These two impacts alone are enough for consideration but a third benefit is positioning yourself to be able to take control over more of your energy needs as technologies present themselves to do so.

Electricity market volatility makes the case for ownership even stronger

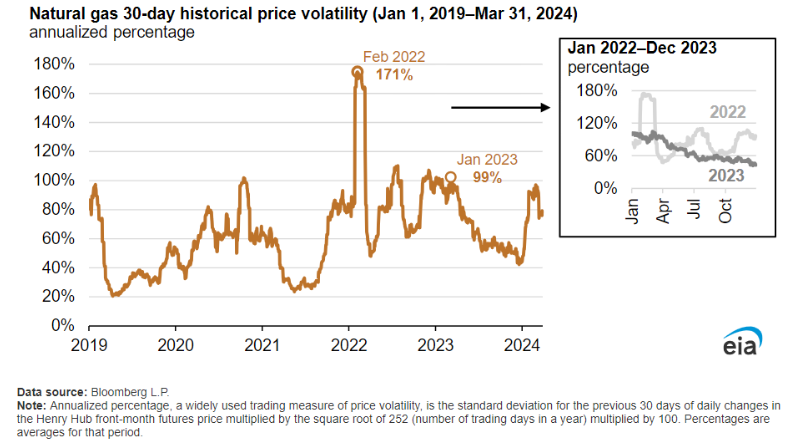

If you’re a large energy consumer, then you’re no stranger to the volatility in electricity markets over the past few years. Large swings in the price of natural gas and the growing demand for electricity are some of the drivers.

Source: EIA

Historically, electricity markets were fairly reliable in delivering a slightly escalating cost of electricity over a long period of time. This price predictability was particularly true for commercial and industrial (C&I) consumers, and therefore they could reasonably forecast these costs well into the future thus reducing a need for control of any related assets.

Unfortunately, this is no longer the case. Commercial and industrial consumers of electricity are increasingly subject to price volatility and the resultant price increases.

The only options to mitigate this risk are to put in place a contractual hedge (through a power purchase agreement, “PPA” or “vPPA”) or to generate electricity that avoids fuel price risk.

Why owning on-site solar makes sense

Owning solar power generation is a great way to earn attractive returns while de-risking the core operations of your business. Fortunately, it’s a relatively simple asset transaction that can be replicated at multiple sites in the future. It is more akin to a lighting LED upgrade project than installing a diesel generator, since the total kWh used goes down but all other uses are relatively the same.

Plus, further opportunities for either adding storage, adjusting to a TOU (time-of-use) rate structure, or adding some amount of full backup generation would be easier once a solar generator is installed.

In sum, investing in an energy generating asset that is not exposed to fuel price volatility reduces electricity costs now while delivering healthy returns as an asset on the books. Best of all, this relatively straightforward transaction can hedge your long-term exposure to electricity, a mission-critical input to your business.

Learn More

Does it seem like onsite solar might be a good solution to meet your economic and energy goals? Fill out the form below to get started.

Nokomis Energy is a clean energy developer focused on the Upper Midwest and Mountain West regions. Our mission is to identify opportunities to create clean, low-cost energy projects for our customers. We work directly with our customers and partners to implement and build clean energy solutions that work for your specific needs.